Imagine a world where industrial software isn’t just a tool but a transformative force reshaping entire industries. This article explores the top 10 trends in industrial software, highlighting innovations like the integration of design and simulation, generative design, and the rise of subscription models. Discover how these advancements will revolutionize manufacturing, making processes more efficient and designs more sophisticated. By the end, you’ll understand the critical changes underway and how they will impact the future of industrial technology.

As digital technology advances, the industry appears to be entering the transitional phase of platform adolescence.

Industrial software, once merely a tool, is becoming a significant force.

It is undergoing a transformation like never before.

This transformation started over a decade ago and is now starting to take shape with the help of technological advancements such as the industrial Internet and 5G.

It will take another ten to twenty years for the full impact of this change to be felt in the industry.

By then, the instrumental aspect of industrial software may no longer exist, and instead it will shape the direction of the industry in a more profound and covert manner.

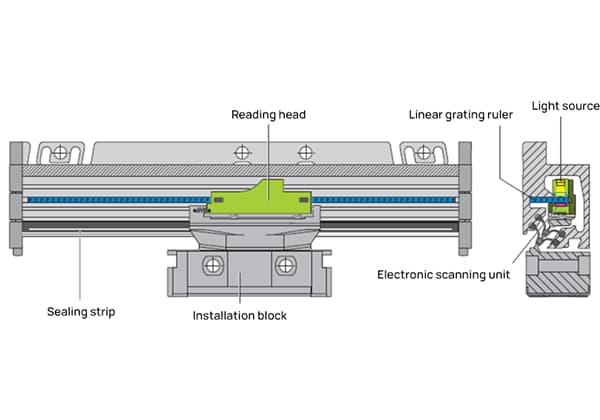

In the past, CAD (Computer-Aided Design) and CAE (Computer-Aided Engineering) were two separate domains. However, with the integration of design and simulation, a few industrial software solutions now bridge both areas. The integration of design and simulation is becoming increasingly apparent through buzzwords such as CPS (Cyber-Physical Systems), digital twin, and digital object fusion. This trend can be seen in the recent developments of companies such as Siemens, Dassault Systèmes, and Autodesk.

Dassault Systèmes has recently focused on strengthening its presence in the simulation field, which has further boosted the simulation brand of the company. In the last five years, half of their mergers and acquisitions have been for simulation software companies. Similarly, Siemens has also acquired several simulation companies, including CD-adapco, a global provider of engineering multidisciplinary simulation software, for nearly $1 billion in 2016. Autodesk is also entering the simulation market through acquisitions and the launch of its own simulation products.

This close integration of CAD and CAE means that design-as-simulation will become the norm in the industrial sector. The traditional divide between CAD and CAE is being broken down by CAD vendors, and the importance of geometry engines will be reduced as physical numerical simulation precedes physical implementation. This puts pressure on manufacturers who only offer CAD and CAE solutions, including PTC’s CAD division and simulation giant ANSYS. To respond to this trend, ANSYS and PTC have formed an alliance to jointly develop “simulation-driven design” solutions, providing users with a unified modeling and simulation environment and eliminating the boundary between design and simulation.

The Apex platform, launched by MSC (now owned by Hexagon) in 2014, was created to address the challenge of integrating CAD and CAE. The convergence of these two technologies means that the manufacturing process is shifted to the front-end, allowing the design to perform more functions that were previously handled by prototyping and testing. This has made the implementation of DFX series, such as “design for manufacturing” (DFM) and safety-oriented (DFS), more feasible and widespread.

Generative design is a software that automatically performs stress analysis and topology optimization based on the component’s load boundary conditions, providing the most appropriate solution for various structural optimizations. With the current excitement surrounding artificial intelligence (AI), some may see generative design as a new chapter in AI by CAD manufacturers. However, it is not necessarily so. Allowing computers to generate more topological structures by applying constraints is not a new concept. What is new is how these structurally and materially challenging designs will be brought to life.

Additive manufacturing provides an answer to these intricate structural shapes, as 3D printing can easily produce the designs generated by computers. Autodesk has been working in this area for years, developing its Within software based on the technology of Within Labs, a London-based software company acquired by Autodesk in 2014. Other derivative design projects, such as ProjectDreamcatcher, are also in development. The seats designed for Airbus have added to the reputation of generative design, with their intricate structures being particularly impressive.

Figure 1 / Generative design of the NASA Saturn lander

In the field of additive manufacturing, there is a growing presence of CAD and CAE technologies. Autodesk offers Netfabb for lattice optimization and metal additive manufacturing simulation. PTC’s Creo 4.0 has also simplified the process between 3D CAD and 3D printing to facilitate the creation of uniform lattices. All these companies are recognizing the importance of this new direction.

In May 2017, Solid Edge ST10 was released, offering generative design capabilities with improvements in design, simulation, and collaboration. PTC, a company active in the IoT world, has realized the value of this trend and acquired Frustum, a new company founded in 2012, for about $70 million in November 2018. This acquisition allows PTC to integrate Frustum’s AI-driven generative design tools into its core CAD software portfolio.

Autodesk has made significant efforts to showcase the impact of generative design. The company’s executives have even quipped that “CAD is a lie,” and that “generative design is making it truly worthy of its name.” However, more examples are needed to demonstrate that this is a significant step forward in manufacturing at scale.

Paper is considered to be the ultimate solution in manufacturing. For a long time, the two-dimensional blueprint was the symbol of the chief engineer’s authority in design and on the shop floor. Instructions, also known as “paper orders,” were a conventional method of communicating decisions, much like an army post. The more complex the manufacturing process, the more complex the data transfer, leading to a higher likelihood of errors in information transmission through paper, signage, and other media.

In the 1990s, Boeing introduced paperless technology. Although the concept of paperless is simple and straightforward, its implementation in design and manufacturing, as well as throughout the entire factory, can be challenging. One of the first airplanes to be designed digitally was the Boeing 777, which has been in development since 1990, and Boeing continues to work on this problem.

Paperless is seen as the solution to this issue. Paper and forms are viewed as symbols of siloed data, causing a “data intestinal blockage” in the factory. This is a common problem in traditional factories. However, it’s expected that a complete solution will be found.

Augmented reality (AR) could redefine data transmission as a new medium. Design development engineers are already exploring the possibility of dragging and dropping objects in the air, as seen in the movie Iron Man, with companies like Lockheed Martin leading the way. AR devices, supported by rich software, have also come to the aid of factory operators. The PTC ThingWorx Operator Advisor uses a new 3D design and work instructions that can be delivered to frontline operators via AR. Vestas, the world’s largest wind turbine equipment manufacturer based in Denmark, has taken the first step into this 3D era. The company aims to solve the problem of “breakpoint data” by simplifying the collection, synthesis, and delivery of critical operational data.

This change in the way information is communicated to shop floor employees will be significant, marking the end of the era of “text” and “paper orders.” Three-dimensional data and instructions are not just a matter of sending data, but transmitting knowledge through a feeling, not just a textual description. The instructions needed now are not on a piece of paper, but on a screen and in a feeling.

Paperless is becoming more concrete with the rise of “screenification.” At the Mobile World Congress 2019 in Barcelona, PTC’s augmented reality Vuforia solution was already integrated into Microsoft’s HoloLens 2, with new gestures, voice augmentation, and tracking features that eliminate the need for complicated programming work. Companies like Howden, an air engineering company, have already started using the technology to enhance the customer experience.

AR frees people’s hands, allowing them to interact with data in a new way, whether in the design studio or in the factory. People can now wave their hands like conductors, driving data in a whole new way. The subtext behind this technology is much more significant. Companies like Caterpillar, the world’s largest construction machinery manufacturer, no longer provide drawings to their customers. Non-authorized service engineers cannot repair an oil circuit without guessing. Users may have all the details, but they cannot see the data.

What does the next generation of workers look like? They are interconnected workers with a “second blood vessel” where all sorts of data travel through. With the help of AR technology, these workers can see it all. The question arises, will “full screen” become the standard for lean, challenging the benchmarking practices and lighthouse culture that a plant has developed over the years?

The human capacity to tackle complex issues is limited. Systems engineering adopts a top-level, holistic approach and utilizes models as a way to express complexity at a higher level of abstraction. This enhances humans’ ability to deal with complexity.

Atego, now part of PTC, is a modular-based systems and software engineering company that emphasizes a collaborative approach to building complex systems and addresses the development of mechanical, electrical, and software components.

The United States has the highest defense spending in the world, crucial for national competitiveness. The U.S. Department of Defense procurement involves 150,000 people, encompassing research and development, manufacturing, and maintenance, with nearly 30% being systems engineers.

Future design requires systemic thinking, and model-based systems engineering is essential for the production of large weaponry. However, this remains a challenge. The aerospace industry was the first to adopt this approach, but the complexity of products makes it a slow process.

A comprehensive systems engineering or model-based design approach involves multiple engineering disciplines, including machine, electromagnetic, and heat engineering. The increasing demand for smart and connected products, such as cars, home appliances, consumer goods, and mobile devices, adds to this complexity.

The Model-Based Definition (MBD), promoted by Boeing, is gaining widespread acceptance. Many CAD companies now support relevant PMI standards for product manufacturing information related to MBD, and CAD software programs express support for the MBD standard.

In 2013, Solidworks introduced the MBD module, but currently, enterprise users still face multiple MBD standards that cannot be unified due to limitations of 3D software. A complete end-to-end MBSE technology foundation is necessary to support the full lifecycle.

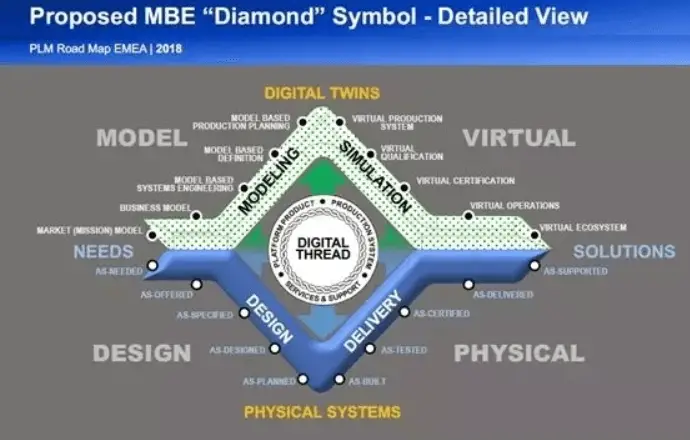

Boeing has adopted a new “rhombic” description to enhance the traditional “V” shape of the systems engineering path. The rhombic description highlights the need for constant interaction between the virtual model and the physical world to form an interconnected environment, moving away from document-driven situations.

The digital twin offers exciting possibilities, but its implementation requires a product defined based on a model. It remains a lotus floating on its foundation, the continuous lotus root.

Figure 2/Senior Technical Don Farr, Boeing R&D Technology 2018

For Chinese manufacturers, new concerns have arisen regarding the constant push for Model-Based Definition (MBD). This push will hinder the efforts of Chinese CAD and CAE software vendors as the standards set by these models will make it difficult for users to migrate data in the future. The barriers imposed by foreign software will be even greater for users.

Storing 3D models and data separately may be a viable approach, but Chinese enterprises lack the willingness to form common standards and systems, making it challenging to create synergies. Additionally, users are unable to break away from existing data structures and usage habits, making the future outlook uncertain.

Furthermore, many domestic industrial software have been drawn into the industrial Internet, while the international 10303 standard system has nearly 200 standards, constituting a deep MBD barrier. Domestic enterprises have seen limited research and progress in this area.

The complexity of large enterprises, such as the aerospace industry, has increased, leading to a greater reliance on large mainstream software. This has resulted in the software becoming more closed and monopolized, leaving little opportunity or development space for other upstream and downstream software.

Many companies’ technical exchanges are based on large-scale overall solutions like MBSE and do not mention any product names or brands. Once an enterprise adopts an overall solution, it becomes challenging for other products to access it.

The way software tools are being sold is undergoing a change, shifting from a one-time license to a subscription model. This model doesn’t necessarily have to be cloud-based, as it can still be installed on-premise, but is accessed through a regularly licensed password as part of a subscription.

This model is beneficial for both the user enterprise and the software company. The user enterprise can easily adjust the number of users to meet their needs, and have instant access to the latest software version. For the software company, it ensures a continuous cash flow from users.

While the revenue from a single user company may decrease temporarily, the revenue from subscription services is expected to surpass the revenue from fixed usage rights over a few years. Additionally, the large amount of data generated by application software can be easily linked to software tools with this model.

In terms of software development, software vendors prefer the subscription model as it provides a stable source of revenue. This model also makes long-term updates more reasonable. The success of this model has been demonstrated in international markets, with 70-80% of Dassault’s annual revenue in Europe, America, and Japan coming from annual rental income and only 20-30% from a one-time purchase of a perpetual license cost.

Software companies in Europe and the United States are comfortable with this model as it secures most of their income in advance and allows engineers to focus on research and development. Autodesk’s transition to the subscription model has not been smooth, with big layoffs in 2017 related to the promotion of this model.

Previously, with low Internet penetration, it was challenging for vendors or authors to use the web for ongoing maintenance and upgrades, and much software was a one-time deal. However, with the widespread availability of the internet, conditions for updating software anytime are almost perfect, with no barriers to online implementation and perfect customer support and iterative upgrades for the product.

The popularity of the subscription-based system for industrial software is on the rise, driven by the growth of cloud computing. The Chinese market is still resisting this change due to its unique market characteristics, with one-time purchases being the preferred approach. This is due to the budget for software upgrades being separate from the budget for purchasing software services, and the value of software services not being widely recognized in China.

The subscription system may pose a threat to the data monopoly of Chinese users, but it also presents a huge opportunity for domestic software vendors to improve their research and development.

The era of viewing industrial software as just a tool may be coming to an end. In February 2019, Dassault Systèmes announced that after 21 years, the name of the SolidWorks World conference would no longer exist, but would become the 3D Experience World. This change in name sends a clear message that the brand of a single software tool is no longer as significant, and the platform will encompass everything.

Dassault Systèmes is promoting its 3D EXPERIENCE platform as a top-level strategy and industrial software, with its strong association with being a tool, is being redefined to encompass its standalone existence. This shift in thinking is comparable to being asked if you want an axe or a piece of wood for your campfire.

The change in name and approach also signals a renewal in the business model. Industrial software providers are seeking to extract more value from the entire design-manufacturing process, with a focus on manufacturing as a service. This is why Dassault Systèmes is committed to connecting the front-end of design with the back-end of manufacturing. The company’s 2014 acquisition of RTT, a high-end 3D visualization software for marketing and display, aligns with this philosophy.

The recent market trends in computer-aided manufacturing (CAM) can be understood in the context of this shift. CAM software, once independent, has now become integrated into software platform services. For example, Solidworks launched a CAM-oriented version in 2017, while Hexagon acquired French CAM company SPRING in 2018.

The key factor behind the growth of these platform services is the community and collaboration. The concept of a software community has existed for some time, with Autodesk supporting a partnership ecosystem in the early 1990s, leading to the emergence of many secondary development industrial software companies. However, after Autodesk acquired companies such as Demeco, these secondary developers struggled to compete and eventually transformed and dispersed.

As tools transition to platforms, small and medium-sized enterprises (SMEs) may become just a small part of the larger picture. The relationship between partners and the platform is similar to that of iron and grass; partners are just one component. The existence of such platforms will be tempting for SMEs, but it also means that platform-based businesses must be ready to play the role of “utility player.”

Industrial software companies are also preparing to shift their platforms to serve SMEs. A recent example is Dassault’s entry into the enterprise resource planning (ERP) system. In 2018, Dassault Systèmes acquired manufacturing ERP software company IQMS for $425 million and renamed it DELMIAWORKS.

The biggest step that product lifecycle management (PLM) software vendors can take to expand their reach is by combining design-side data with business data. This year, Dassault Systèmes SOLIDWORKS launched 3DEXPERIENCE.WORKS, which provides SMB users with a single digital environment for combining social collaboration with design, simulation, manufacturing, and ERP functionality.

The era of tools is ending, and this is not good news for China’s struggling PLM vendors. While they may still be determined to compete, the competition has already moved ahead. The difference between the two generations is not just a matter of years, but of eras.

The concept of Software as a Service (SaaS) continues to evolve in the industrial sector, with cloud-based subscription models for industrial software becoming an increasingly popular option for companies. These cloud and online industrial software can be accessed directly through a local browser or web and mobile applications. Unlike traditional software that is installed on a local computer, SaaS is updated remotely and accessed through a subscription, often on an annual or monthly basis.

A decade ago, the concept of cloud CAD was widely discussed, but it was considered highly complex at the time. Michael Riddle, one of the founders of Autodesk and a well-known CAD architect, noted that cloud CAD was more than ten times as complex as desktop CAD. This was due to not only the large number of lines of code, but also the difficulty of modeling and the complexity that could be equivalent to chess. Rebuilding the architecture system was necessary, which was a daunting task for mature software vendors.

In 1994, Autodesk released AutoCAD Version 13, but it received largely negative feedback. The software had completely rebuilt the architecture and rewritten the code, resulting in a costly disaster for Autodesk. In 2012, the founders of Solidworks founded Onshape to provide online CAD services, which was met with a strong reaction. Autodesk’s Fusion360 quickly followed, and Chinese software companies, such as Horton and Lich, have also entered the market.

In the domain of CAE, new small businesses have the option of using online services. Many domestic CAE software companies, such as Beijing Cloud Road, Shanghai Digital Qiao, and Lanwei, are moving towards cloud-based offerings as a way to avoid competition with larger rivals and find a niche in the market.

Onshape received a total of $170 million in April 2016 after four rounds of financing, but has not received any additional funding since. Although Onshape was an early entrant in the market, it has not had the impact that was originally expected. The success of cloud CAD products depends on the quality of the basic modeling, and many traditional CAD vendors have been spurred into action by Onshape’s success. In 2018, CATIA launched xDesign, which has a similar interface to CATIA, in response to the growing impact of online design software like Onshape. The real charm of online design is the huge synergistic effect it brings, enabling “crowd-sourcing, crowd-creation, and collective collaboration”.

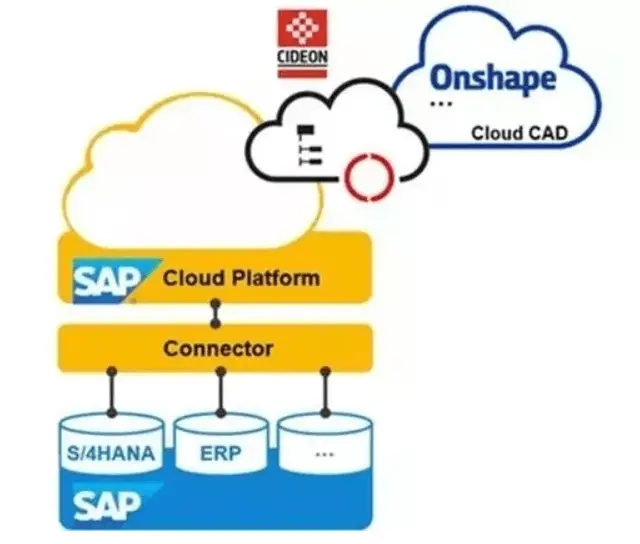

As the industrial cloud continues to spread, there will be a growing number of intermediate software vendors offering data conversion services. For example, companies like CIDEON will connect engineering data from cloud CAD with cloud platforms like SAP in a seamless and concise manner.

Figure 3 / Heterogeneous data linkage

For its strategic direction as a cloud platform provider, Dassault considered the hardware resources of a cloud computing facility carefully. In 2011, Dassault Systèmes made a strategic investment in Outscale, a newly founded cloud computing company. By June 2017, Dassault Systèmes increased its investment to acquire a majority stake in the company.

The 3D Experience platform offered by Dassault Systèmes is delivered through Outscale’s cloud services in over a dozen data centers globally. This platform takes full advantage of hardware and software integration and can be used by enterprises of all sizes.

This infrastructure-agnostic, cloud-based platform delivers Windows applications and workflows from the cloud, breaking away from traditional virtual desktop solutions such as Citrix or VMware, which are designed for single-tenant, inelastic data center infrastructure.

It is worth noting that the architecture of Intel’s X86 on the PC and ARM on mobile terminals are vastly different.

Figure 4 / Cloud facilities for industrial cloud software

A lightweight cloud architecture that is designed to be flexible and meet users’ elastic access needs is ideal for the industrial cloud, making industrial software popular in this environment. The migration of industrial software to cloud platforms is poised to compete in the broader small and medium-sized business (SMB) market.

“Cloud PLM” provides small and medium-sized PLM users with more options to tailor solutions to their unique business and engineering requirements. This shift is changing the way PLM businesses and deployments are managed.

The rapid development of the industrial Internet provides a favorable environment for “cloud-born” software to thrive.

The PLM (Product Life Cycle Management) concept encompasses the “one word for life” mentality. It originated from “Product Data Management” (PDM) and was initially a feature of CAD software companies. However, it never fully materialized.

In 2005, PLM became a field that was no longer exclusive to CAD tool companies, attracting many new players with impressive credentials. In 2007, Oracle acquired PLM software company Agile, and in 2009, SAP launched its own PLM for the Asia-Pacific region.

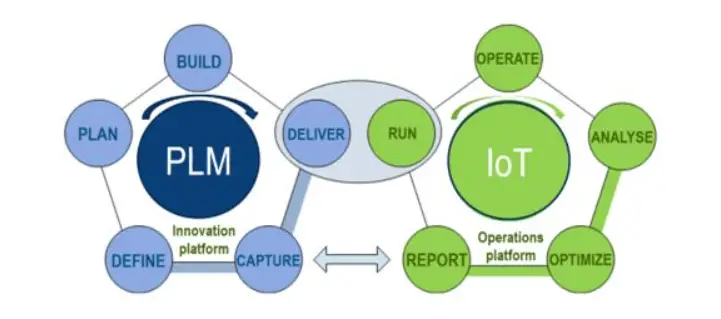

The relationship between IoT (Internet of Things) and PLM is a topic of debate, with some seeing it as IoT equals PLM, while others view it as IoT plus PLM. For PTC, the CEO stated firmly that “IoT is PLM” two years ago.

Despite the emphasis on the life cycle in PLM, many products still fail to undergo full life cycle management. For example, a refrigerator or a car may be forgotten after leaving the factory and become a “product orphan” for manufacturers. This has led to many PLM software systems being reduced to PDM and engineering change management.

In the IoT era, this could lead to a narrow-minded approach. Products are now providing companies with increased visibility and insight, making PLM more of a business idea than a product in and of itself. In this sense, IoT has become a catalyst for the activation of this concept.

Siemens’ move towards IoT is driven by the roar of on-site machines, not PLM considerations. As an automation company, IoT strategy is an inevitable choice, so it is not surprising that it is moving towards integration with PLM. However, Dassault’s approach is slower. The company is gradually increasing the connection between its machines and business processes through its acquired production scheduling management software Apriso, but this is more of a tactical solution than a strategic plan.

Figure 5/ Relationship between PLM and IoT

So, is IoT a parallel twin or the firstborn of PLM? To answer this relationship, two boundaries need to be identified. The first boundary is the attitude towards the equipment within the factory, which is consistently answered by all software companies. The second boundary is whether PLM should extend beyond the factory gates and connect the relationship between people and products. This is the most critical separatrix for the strategic partition of industrial software companies.

PTC is the most aggressive in making choices, aligning with IT companies like SAP and Oracle. Siemens has made a choice regarding crucial equipment, while Dassault and Autodesk have found the courage to answer this question. The most likely breakthrough in simulation and automated driving will provide additional insight.

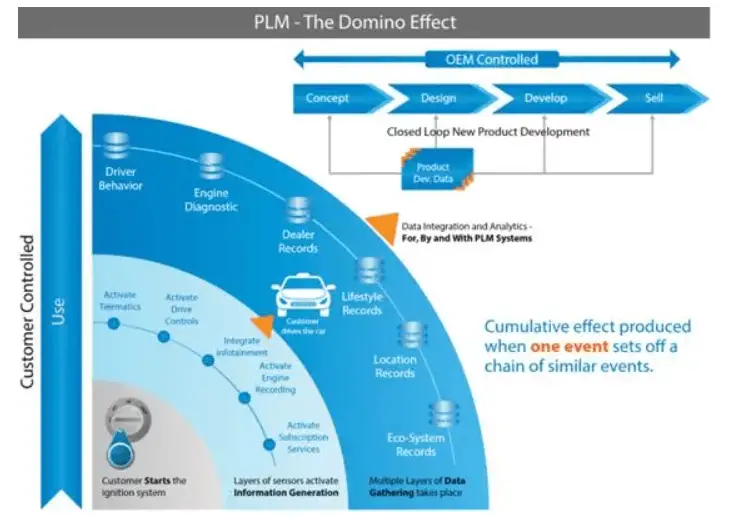

Figure 6 / The domino effect of IoT activating automotive PLM (Source: infosys)

So, how do we recognize the boundaries of PLM in the era of IoT? Should we allow it to continue to expand and incorporate unfulfilled ideas from the past, or should we let it fade away and allow IoT to reinvigorate the value of the data center and further solidify the data-driven approach? The answer depends on people’s habits and preferences.

There’s no denying that the semiconductor industry is expensive.

The primary reason for this is the electronic design automation (EDA) software used for chip design.

In the 1970s and 1980s, the gap between EDA and mechanical CAD (MCAD) software was not significant, as many CAD manufacturers offered both. However, MCAD software soon surpassed EDA in popularity.

But as the semiconductor industry grew, EDA took a more professional approach, diverging from electric apparatus CAD. It became closely tied to intellectual property.

Today, major players in the field, such as Synopsys, Cadence, and Siemens Mentor, dominate the chip design market.

However, electric apparatus CAD/CAE vendors are eager to break down the division between the two.

In 2008, simulation software giant ANSYS entered the EDA field with its acquisition of Ansoft Corporation for approximately $800 million.

ANSYS later acquired analog software provider Apache Design Solutions for $310 million in cash, further strengthening its position in integrated circuit simulation.

In November 2016, Siemens acquired MentorGraphics, one of the world’s top three EDA software providers, for $4.5 billion.

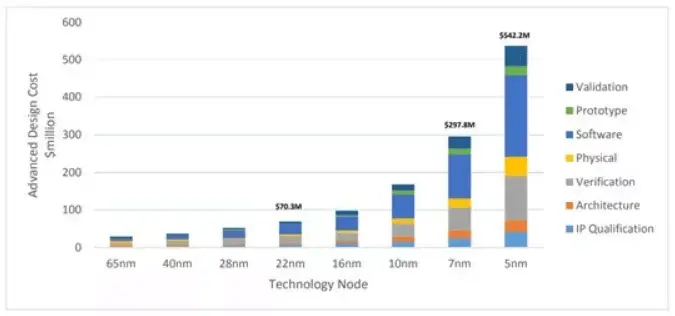

The cost of advanced design has skyrocketed, with expenses rising from $28 million at 65nm to a staggering $540 million at the current 5nm, a 20-fold increase. This highlights the incredibly costly nature of chip design.

Figure 7/Advanced Design Cost Evolution (source: IBS data)

With each new generation of technology from 65nm to 40nm and then to 28nm, about 50% of the code in the software needs to be rewritten.

As technology advances to the nanoscale, there are many physical phenomena that are encountered for the first time, leading to a significant increase in the complexity of operations.

In many cases, software limitations are the key factor holding back physical breakthroughs.

The industry’s reliance on software is now immense.

In this sense, EDA software vendors are crucial to the industry, but they must learn to balance their own interests with the needs of their customers.

The same is true in the Chinese CAD market. These platform-tool industrial software vendors must control their impulses and not prioritize their own profits over the needs of their agents and users.

For example, in 2018, a large CAD manufacturer increased its operating income by 10-15% without even informing its agents. Many agents and users feel like they are at the mercy of these software vendors and their aggressive business practices.

It is important to maintain a balance and not take advantage of the situation.

The highest level of industrial software may lead to its own elimination.

When the user wants to dig a hole in the ground, tools such as chisels and drills become redundant.

It is becoming increasingly common to see the combination of software and hardware in the industrial world.

Industrial software and automation hardware are converging.

Siemens automation and PLM are closely integrated, creating a digital enterprise.

In 2017, Schneider acquired a 60% stake in AVIVA for nearly RMB 5 billion, an example of the “engineering embraces industrial software” trend.

Rockwell invested US$1 billion, accounting for 8.4% of PTC’s shares, marking the start of a strategic collaboration.

The early simulation software MSC was acquired by Swedish metrology equipment company Hexagon.

The era of profits from software and hardware is a thing of the past.

The injection of software is making traditional hardware profits, which were once thin, as thick as a server.

The boundaries between systems are disappearing, leading to the merging of traditional mechanical design and simulation CAD/CAM/CAE software, electronic design automation software EDA, and other software such as manufacturing execution system MES and human-machine interface HMI, among others.

Software ubiquity is the key to this transformation.

Behind the Industrial Internet, software is the star.

Only software can unlock the value of machines and data.

It is no longer just a suite of tools, but a game-changer for the industry.

Ubiquitous yet invisible, this may be the future of industrial software.

But it is only on this intangible foundation that the rise of smart manufacturing and the industrial internet can be built.

What is intangible?

Air is intangible, yet it dominates the existence of life.

The memory of industrial software as a tool is gradually fading.

It’s becoming difficult to categorize a PLM vendor as solely CAD or CAE.

Although it is a small market, it acts as a pivotal lever in the industry.

Small and seemingly insignificant, this invisible industrial software is driving the direction of the future industry and serves as a new fundamental power for the emerging industry.