Have you ever wondered how different industries calculate their steel consumption? Understanding this process is crucial, as it influences everything from construction to automotive manufacturing. This article delves into the formulas and factors used to determine steel needs across various sectors. By reading, you’ll gain insights into how steel consumption impacts major industries and the methods used to estimate these requirements accurately.

How is steel consumption calculated across major industries?

Crude steel consumption = Crude steel production – [(Steel exports – steel imports) x 10.96 + billet exports – billet imports + ingot exports – ingot imports]

The real estate sector is one of the main industries for steel demand. Its operational condition directly affects the changes in the demand for construction steel.

| Steel Usage in Housing | ||

| Types | Steel Usage in KG/m2 | Median Value |

| Multi-story Masonry Residence | 30 | 30 |

| Multi-story Framework | 38-42 | 40 |

| Low-rise Buildings of 11-12 Stories | 50-52 | 51 |

| High-rise Buildings of 17-18 Stories | 54-60 | 56 |

| High-rise Building of 30 Stories with a Height of 94m | 65-75 | 70 |

| High-rise Serviced Apartments of 28 Stories with a Height of 90m | 65-70 | 67 |

| Surplus of Concrete and Steel Usage in Villas Compared to Multi-story Masonry Residences and High-rises of 11-12 Stories | 50-52 | 51 |

| Industrial Buildings | 30-70 | 50 |

| The above residences are designed according to the Seismic Design Rules for 7 Degree Zone. | ||

The primary indicators that directly stimulate the demand for steel in real estate are the construction area.

The linear relationship between construction area (X) and steel usage (Y) can be calculated as:

Y = 6400 + 0.0273X

Infrastructure includes railways, highways, bridges, airports, communication, electricity, water utilities, and other public facilities. This also encompasses social infrastructure like education, science and technology, healthcare, sports, and culture.

Steel usage in railways

Steel materials are primarily used for newly constructed railways, maintenance and modification of existing railways, locomotive and vehicle manufacturing and repairs, and railway bridge construction.

For every one hundred million yuan invested in railway construction, an average of 0.333 thousand tons of steel is consumed.

Generally estimating, for every one hundred million yuan invested in urban rail transit construction, about ten thousand tons of steel consumption will be stimulated (including stations, equipment, etc.)

Steel used in airport construction

Every investment of 10 billion yuan consumes over 10,000 tons of steel.

Highways consume steel

In highway construction, the primary demands come from expressway, primary road, secondary road construction, and other road network construction. Among these, the steel demand for expressway construction is the most significant.

Currently, the steel consumption for every kilometer of expressway in our country is approximately 400-500 tons, estimated with a median value of 450 tons.

Port construction requires steel

Steel used in port construction primarily refers to the civil engineering components, which include the wharf, approach bridge, foundation protection, and stockyard construction.

The construction of a concrete port berth requires approximately 1,000 tons of steel. Including the materials used in transit, the total will not exceed 2,000 tons. Conversely, building a steel column port berth requires a significantly larger quantity of steel.

If we include 8% for stockyard and warehouse steel usage, it is estimated that an average berth construction requires about 2,500 tons of steel.

The automotive industry is a significant downstream sector for the steel industry, with various types of steel accounting for approximately 70% of the total weight of a car.

| Model | Passenger Vehicles | Commercial Vehicles | ||||

| Sedans | SUV | MPV | Crossover Vehicles | Trucks (including Chassis and Semi-trailers) | Buses | |

| Estimated Sales in 2015, in Ten Thousand Units | 1251 | 510 | 258 | 106 | 323 | 65 |

| Growth Rate, % | 1 | 25 | 35 | 20 | 1.3 | 6.5 |

| Average Steel Consumption per Vehicle, in Tons | 1.16 | 1.55 | 1.55 | 0.88 | 3.42 | 4.49 |

| Steel Consumption by Model, in Ten Thousand Tons | 1451.16 | 790.5 | 399.9 | 93.28 | 1104.7 | 291.85 |

| Total Steel Consumption, in Ten Thousand Tons | 4131.40 | |||||

The home appliance industry is one of the significant downstream steel-consuming sectors. Typically, large home appliances comprise about 90% steel, while small appliances account for about 10%, and sheet metal makes up 95% of all steel consumption.

On average, a washing machine uses 21 kilograms of steel, a refrigerator uses 34 kilograms, and an air conditioner uses 30 kilograms. These three main products account for about 80% of the steel consumption in the entire home appliance industry.

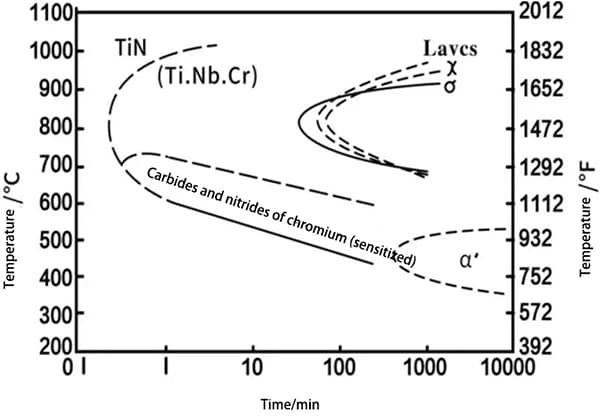

The shipbuilding industry’s steel demand primarily includes sheet metal, profiles, and pipes, with sheet metal being the majority. All sheet metal used in shipbuilding must be approved by a classification society, and it mostly comprises medium and thick plates.

A small amount of thin plates is primarily used in the superstructure of the ship. The type of ship and tonnage greatly affect the quantity of steel consumed.

Cargo Ships

The construction of a 12,000-tonne cargo ship requires 3,600 tonnes of steel. A 25,000-tonne cargo ship needs 5,300 tonnes of steel, and a 66,000-tonne cargo ship requires 11,000 tonnes of steel.

Oil Tankers

Building a 100,000-tonne oil tanker requires 16,000 tonnes of steel. A 200,000-tonne oil tanker needs 24,000 tonnes of steel, and a 300,000-tonne oil tanker requires 40,000 tonnes of steel.

The above steel requirements are based on the ship design and do not account for the actual utilization rate of the steel.

Petroleum and natural gas drilling, transportation, machinery, ships, automobiles, home appliances, real estate, and infrastructure all involve steel usage.

Real estate, machinery, and petroleum and natural gas industries are the primary consumers of steel pipes.

| Apparent Consumption (in 10,000 tons) | Year-on-Year Growth Rate | |

| Steel Pipe | 8868 | 10.75% |

| Welded Steel Pipe | 6515 | 21.23% |

| Seamless Steel Pipe | 2422 | -8.01% |